Power grid operator

NGCP billed P2.4B worth of CSR, PR expenses to consumers

Since January 2023, the Energy Regulatory

Commission has held 14 hearings to determine how much the NGCP

should charge customers. The result of the investigation could mean

refunds or higher electricity bills in the coming years.

By

ELYSSA LOPEZ

Philippine Center for Investigative Journalism

November 7, 2023

MANILA – As the sole public utility

in charge of power transmission lines, the chief mandate of the

National Grid Corporation of the Philippines (NGCP) is to ensure the

reliability of the country’s electricity. So when a government

representative found that the company had included corporate social

responsibility (CSR) activities as part of its operating expenses,

she sought an explanation.

“Are CSR expenses necessary for the provision of the transmission

services by NGCP?” asked Marbeth Laconico, corporate secretary of

the National Transmission Corporation (TransCo), during a hearing

called by regulators.

Transco is the state entity that owns the power transmission grid,

which brings power supply from generating plants to electricity

distributors. NGCP, owned by a consortium of Filipino tycoons and

the State Grid Corporation of China, won the concession deal to

operate it after a public bidding in 2007.

Questions over the NGCP’s finances have grown in recent years, as

the transmission operator, a state-sanctioned monopoly, reported

higher profitability. Last year, NGCP reported P34.7 billion in net

income on nearly P62 billion in revenues. Net profit margin grew to

56.15% from 47.6% year-on-year.

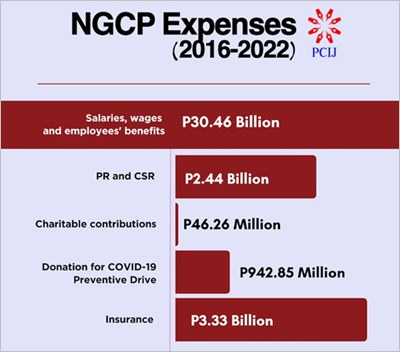

Yet based on its financial statements from 2016 to 2022, NGCP passed

on to consumers P2.4 billion in expenses for “public relations and

corporate social responsibility,” P46.2 million in “charitable

donations,” and a donation of P942 million for a “COVID-19

Preventive Drive.”

“NGCP values not only the quality of [its] transmission service. We

also like to put [a] premium [on] engaging with communities, which I

suppose all companies are undertaking as part of their corporate

social responsibility projects,” Raymund Fontillas, financial

controller of NGCP, told regulators.

Regulators have also sought explanations for the huge amount spent

by the grid operator on salaries and benefits paid to employees, as

well as expenses due to force majeure such as natural calamities.

Since January 2023, the Energy Regulatory Commission (ERC) has held

14 hearings to determine how much the NGCP should charge customers

for the period 2016 to 2022, the fourth round of regulatory reviews.

TransCo and distribution utilities like Meralco grilled the NGCP

during the hearings, where the exchange between TransCo’s Laconico

and NGCP’s Fontillas happened.

Transmission rates are supposed to be set every five years, the

length of a regulatory period. But that has not happened in the past

decade. The last time the NGCP had a regulatory review was in 2010,

which determined the maximum allowable revenue it could earn for

2010 to 2015, the company’s third regulatory period.

The ERC did not call for a formal review of the rates until it

issued the Amended Rules for Setting Transmission Wheeling Rates (RTWR)

in 2022, which officially began the fourth regulatory review.

It does not mean the NGCP has stopped collecting fees from

customers, however. The company has maintained an average net profit

margin of 47.83% from 2016 to 2022. Based on its financial

statements, the company earned an average of P23 billion annually

during the five-year period.

This delay had been the subject of multiple Senate and House

hearings, on top of NGCP’s own delay in the construction of its

interconnection projects that add to consumers' monthly electricity

payments.

At least 9% of what Filipinos pay for electricity goes to

transmission charges. This means that for every P100 spent on the

electricity bill, P9 goes to the NGCP.

How much that 9% costs monthly is determined by the ERC, the

quasi-judicial body in charge of regulating the energy sector.

Insurance bought from shareholder’s firm

The regulatory review hearings provided a venue for the NGCP to

explain the expenses that had been questioned multiple times by

critics.

Among other expenses questioned during the hearings were force

majeure events (FMEs). For the fourth regulatory period, the NGCP is

applying for P1.057 billion worth of FME claims, including related

costs that occurred after 2010 or before the fourth regulatory

period.

Such expenses can be passed on to consumers, subject to the approval

of ERC. Natural disasters such as typhoons, earthquakes, and

landslides, or man-made disasters such as war or riots, are

considered as FMEs.

Under the concession agreement between the NGCP and TransCo, the

former is mandated to insure its assets. NGCP’s financial statements

showed the company spent P2.8 billion in insurance payments from

2018 to 2021, which include industrial all-risk insurance, a type of

policy that allows the policyholder to protect assets from risks

other than fire.

Almost half of insurance policies during the period, or about P1.3

billion, were procured from Prudential Guarantee and Assurance Inc,

one of the country’s largest non-life insurers. Its chairman, Robert

Coyiuto Jr., owns one of the shareholders of NGCP: Calaca High Power

Corp.

Reeva Shane Viado, corporate financial analyst of the Power Sector

Assets and Liabilities Management Corp. (PSALM), the state entity

that restructured the energy sector, sought clarification during the

hearing from NGCP if it had claimed any amount related to FMEs from

its insurance providers.

“It is just our position… that if NGCP has already recovered any

amount from its insurance providers, such amount should not be

included in this revenue under the recovery proposal of NGCP,” Viado

said.

The NGCP representative failed to respond to the question.

The ERC also posed “clarificatory questions” regarding the

compensation package of NGCP employees. In August, the commission

asked NGCP to provide a detailed breakdown and explanation of

salaries, wages, and employee benefits from 2016 to 2020.

Salaries and employee benefits, which totaled P20.9 billion from

2016 to 2020, were the second biggest expense item during the review

period.

Public records showed the NGCP employs about 4,700 employees. That

means each employee earned P4.4 million a year on average, or about

P371,000 a month.

Financial statements also revealed that key management personnel had

enjoyed “short-term benefits” that averaged P346 million from 2016

to 2020. The documents however were silent on what kind of benefits

were paid to these employees.

Fourth regulatory review

With the delay in its regulatory review, the NGCP has been billing

customers based on 2010 rates. A paper by University of the

Philippines economics professor Joel Yu found that the company

“continues to enjoy the rates of return determined by the ERC which

are no longer reflective of the opportunity cost of capital.”

As the rates were determined based on prevailing market conditions

–

just after a financial crisis – a premium was placed on the risk

taken by the NGCP in operating the country’s transmission grid. The

economy has since recovered.

The ERC uses a performance-based review in determining the NGCP’s

wheeling rates. This means the company may obtain cash incentives in

case it performs beyond the target criteria set by the commission.

These criteria are supposed to be reviewed every regulatory period.

Because of delays in the review, the NGCP was allowed to recover an

interim maximum annual revenue from 2016 to 2020 based on criteria

set in 2010. In the ongoing review, the NGCP claimed that customers

owed it P316 billion, or the total revenue requirement from 2016 to

2020.

Based on PCIJ’s analysis of available data, that amount was at least

28% higher than what the NGCP had charged customers during the

review period.

ERC asked the NGCP during the hearings how much the revenue

requirement would translate to per-kilowatt-hour rates, but the grid

operator was unable to reply.

The ERC has decided to catch up on the delay and extend the duration

of the fourth regulatory period, 2016 to 2020, up to 2022, or from

five years to seven years.

The NGCP opposed this, citing the five-year intervals followed in

previous regulatory periods. In October, the ERC denied the plea,

which means the decision on the fourth regulatory review is set to

be published soon.

How the ERC decides on which expenses the NGCP can pass on to

consumers will result in either refunds or higher electricity bills

in the coming years.