San Carlos

bishop: Philippine banks must divest from coal

Press Release

March 1, 2020

CAGAYAN DE ORO –

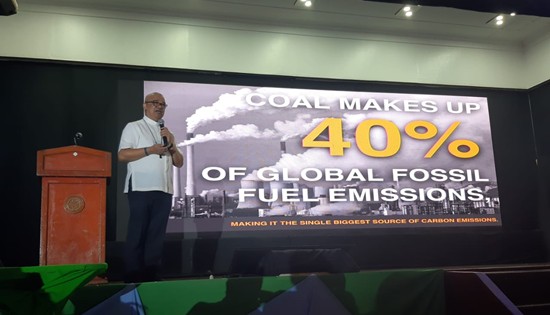

Representing the Withdraw from Coal Campaign, a Church leader on

Friday appealed to Philippine financial institutions to stop funding

the expansion of coal operations in the country and support the

development of renewable energy instead.

The call was made during

the 3rd Philippine Environment Summit, an event that presents

current initiatives contributing to the country’s social and

economic development while conserving the environment, held on 26-28

February at the Grand Caprice Convention Center in Cagayan de Oro.

“As fulfillment of their

moral obligation, Philippine banks must have concrete plans to phase

out coal finance in the time required by today’s climate crisis.

They must have clear policies restricting their exposure to coal,

channeling the funds they divest from it into clean and affordable

renewable energy for all Filipinos,” said Bishop Gerardo Alminaza of

the Diocese of San Carlos, Negros Occidental.

While praising the SONA

2019 directive of President Rodrigo Duterte to “fast-track” the

development of renewable energy resources and reduce dependency on

coal, the bishop pointed out that the continuing dominance of coal

in the country's energy mix calls for even more ambitious ways

forward from different sectors, including the finance industry.

“Banks financing coal are

not only funding the climate crisis, they are also enabling the

continued suffering of coal-affected communities,” he stressed.

In addition to the 16 new

coal-fired power plants added to the national fleet in the last

decade, the Philippines is still looking to add a total of 12,014 MW

of new coal power, making it the ninth biggest coal expansionist in

the world as of 2019.

13 local banks had been

identified to have loaned or underwritten USD 6.303 billion to coal

interests from 2017 to the third quarter of 2019. Two of these

banks, Bank of the Philippine Islands (BPI) and Banco de Oro (BDO)

account for nearly 55% of this finance.

“The IPCC reported that

the world has until 2030 to reduce coal use by 78% from 2010 levels

to avoid even more disastrous climate impacts. As stewards of

Creation, we must unite with our scientists on this and seek to veer

away from a fuel that causes the suffering of our people and

destruction of our Common Home,” Alminaza said.

Alminaza stated that as

the Philippines is one of the most vulnerable nations to climate

change, it must lead in phasing out coal, and financial institutions

must take their role in it seriously – similar to the commitment of

the Catholic Bishops Conference of the Philippines (CBCP) and his

own diocese to divesting its resources from dirty energy

technologies.

A petition letter

addressed to the Bank of the Philippine Islands, the bank with which

many Church organizations have financial relations, was also

circulated during the event and was signed by hundreds of

participants, including Bishop Antonio Ledesma of Cagayan De Oro.

“We appeal to all to join

the calls as written in our letter as expression of our care for our

common home and our future generations. For as one saying goes, ‘we

do not inherit the Earth from our ancestors – we borrow it from our

children.’ We must act swiftly for time is running out,” said

Alminaza.

Launched in Manila in

January and in Visayas in February, "Withdraw from Coal" is a

campaign spearheaded by the Church, civil society, and people’s

organizations urging Philippine banks to divest from businesses

involved in coal power generation and coal extraction.